GEPF NAVIGATES STRONG HEADWINDS

Monday, 16 November 2020, Pretoria

Main Points

-

GEPF asset market value declined by 11.4% from R1.8 trillion in 2019 to R1.64 trillion in 2020. This decrease in the investment value is mainly attributable to the losses incurred in March 2020 as a result of the impact of Covid-19, the downgrade in credit ratings and a persisting low growth environment.

-

Income received during the financial year included:

✓ Dividend income – R34.1 billion

✓ Interest income – R52.3 billion

✓ Property income – R1.8 billion

✓ Contributions received – R 80,2 billion

-

Benefits paid upon member’s resignation, retirement, or death was R111 billion which was an increase of R 8.4 billion against 2018/19 financial year payments. This was mainly due to an increase in pension payments which accounted for 62% of the total benefits paid which was driven by the 5.2% monthly increase granted to pensions and a 3.1% increase in the number of pensioners.

As at 31 March 2020, the end of the financial year 2019/2020, the Government Employees Pension Fund, Africa’s largest pension fund reported a decline in its investment portfolio of R243 billion largely impacted by the turmoil in the South African and global economy in the last quarter of the 2019/2020 financial year.

However, due to the resilience of the GEPF investment strategy, the Fund has recovered the losses incurred and its unaudited value is currently R1.9 trillion. This recouping of losses clearly indicates that the GEPF remains financially sound despite the tough economic conditions that the Fund operated in, in the 2019/2020 financial year.

The financial results however continue to highlight that the performance of the Fund is not isolated from the country’s economic and development constraints. The poor state of the South African economy had a significant impact on the Fund, as the economic climate in the three months leading to 31 March was extremely turbulent and coincided with the end of the Funds 2019/2020 financial year.

Much of the decline in the Funds market value was due to the performance of local equities, capital markets and listed property. The decline in international asset classes was offset by a significant decline in the value of the rand against the dollar. The value of the assets reflects depressed market values as at 31 March 2020.

In the context of a uniquely challenging economic environment, the GEPF did sustain an acceptable overall investment performance with income of R168, 4 billion as a result of investment income of R88, 2 billion and contributions of R80, 2 billion. The fund outperformed its benchmark by 0.22%.

The adverse economic climate in South Africa led to the sharp rise in the bond yields in March 2020 resulting in the value of the Fund’s liabilities reducing considerably as at 31 March 2020. This reduction in liabilities would have resulted in the funding level of the GEPF increasing but the unintended consequence would have been a marked decrease in member exit benefit values (calculated using the Actuarial Interest Factors derived from the actuarial valuation) for the upcoming years, until the results of the next statutory valuation is approved.

Given the abnormal economic shocks and the impact on member benefits, the Board of Trustees resolved to carry out an interim valuation as at 31 March 2020 that will be followed by a statutory valuation as at 31 March 2021. The postponement of the statutory valuation to March 2021 is still within the timeframe prescribed for actuarial valuations by the Government Employees Pension Law.

Benefit payments to members will continue to be made in accordance with the approved Actuarial Interest Factors, which came into effect on 1 July 2019, until the statutory valuation as at 31 March 2021 is completed. These safeguards members from the adverse effect that would have resulted from adopting the Actuarial Interest Factors based on abnormal circumstances as at 31 March 2020.

In line with the Fund’s commitment to ensure all benefits due are paid, the total benefits paid during the year under review increased by R8.4 billion, mainly due to the increase in pension payments, which accounted for 49% of the total increase. The increase in the pension payments were driven by the 5.2% monthly increase granted to pensioners from 1 April 2019 and a 3.1% increase in the number of pensioners.

Whilst the number of pensioners increased, the Fund also experienced a slight increase in active members by 0.3% to 1 269 161 members (2019: 1 265 421).

The GEPF expects the difficult economic climate in South Africa to persist as the economy continues to contract. Following the conclusion of its consultation with the Minister of Finance on its asset-liability modelling the GEPF over a period, will begin to align its strategic asset allocation to match its liability profile. The strategic asset allocation determines how the GEPF allocates funds to asset classes locally and offshore.

The GEPF is keenly aware of the important role it plays in the South African economy, and that its members, pensioners and beneficiaries are impacted by economic, social and environmental challenges, in recognition of which the GEPF continues to direct funds towards the development of the country, inclusive of infrastructure, transformation, sustainability, priority sectors and small –medium enterprises. Such investments however must ensure beneficial returns to the GEPF.

The GEPF expresses its appreciation to its implementing agencies, the Public Investment Corporation (PIC) and Government Pension Administration Agency (GPAA) for the work they do to ensure that the GEPF fulfils its mandate.

/Ends

The Audited Financial statement can viewed on the GEPF website on gepf.datafree.co

Issued by Government Employees Pension Fund

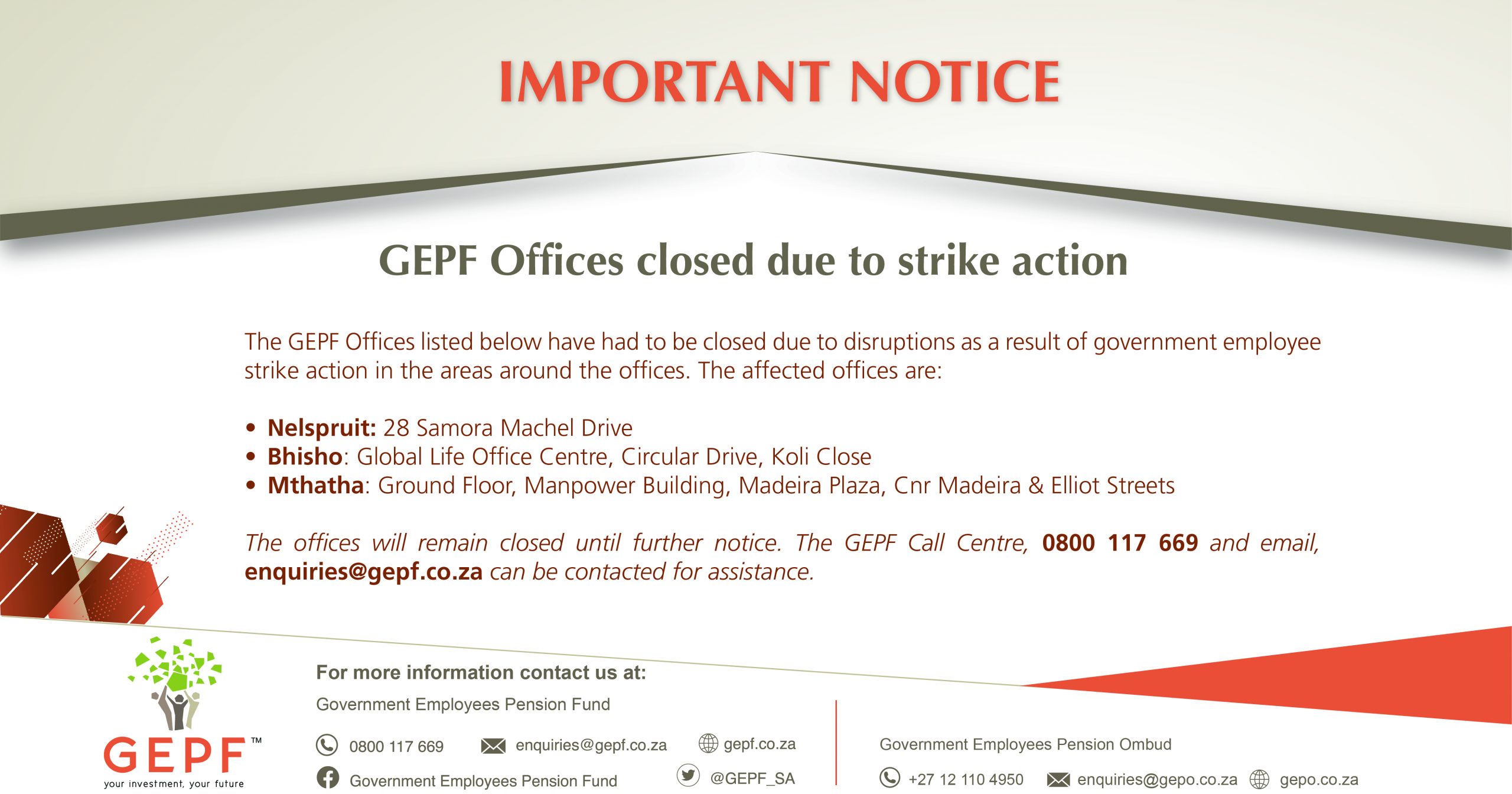

For more information, please contact:

Matau Molapo, Communications division

T: +27 (0) 12 424 7315

M: +27 (0)79 1910 757

E: Matau.molapo@gepf.co.za

About the Government Employees Pension Fund

The Government Employees’ Pension Fund is one of the largest pension funds in the world, with over 1.2 million active members and over 450 000 pensioners and beneficiaries. Our core business, governed by the Government Employees’ Pension Law (1996), is to manage and administer pensions and other benefits for government employees in South Africa.

We work to give members and pensioners peace of mind about their financial security after retirement, moreover during situations of need by ensuring that all funds in our safekeeping is responsibly invested and accounted for and that benefits are paid efficiently, accurately and on time.