Our Investment Objective and Strategy

The long-term objectives of the Government Employees Pension Fund are to provide pensions and other related benefits as promised in the Fund rules to pensioners, members and their beneficiaries, grant annual increases to pensioners, improve benefits and employer contribution rates. This implies that the Fund’s investment strategy must take cognisance of these long term objectives.

Our investment strategy uses a liability driven approach to make investments. The investment strategy was carefully designed in considering the assets and liabilities as well as the investment risk return objectives of the Fund.

How we invest

The Fund has signed an investment mandate with the Public Investment Corporation (PIC), which is a state owned asset manager responsible for investing assets on behalf of the GEPF. The Fund aims to invest responsibly for the long-term by using active and passive investment strategies and following a core-satellite approach when issuing investment mandates. The core portfolios are managed by PIC while the satellite portfolios can be managed by specialist managers in their respective sectors.

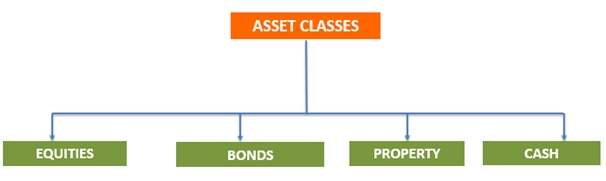

What We Invest In

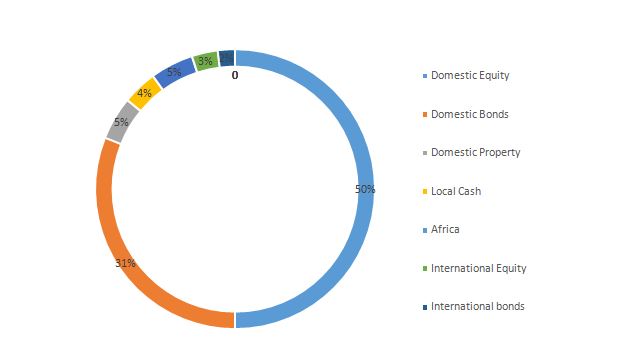

The Fund invests primarily in the South African and African markets, while a small portion is invested in global markets outside the African continent. We primarily invest into four broad asset class categories which are:

Our long term strategic asset allocation is outlined on the chart below.

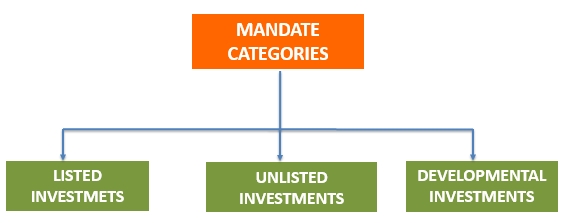

In pursuit of investment returns and risk management, the investment mandates are split into categories below.

A portion of the assets are invested in accordance with the Fund’s developmental investment policy, whose objective is to earn good returns for members and pensioners of the Fund while supporting positive, long-term economic, social and environmental outcomes for society.

Investments Beliefs

The investment beliefs are a set of guiding principles which the Fund and its investment managers apply in their investment decision making process. These investment beliefs are summarised as follows:

- Strategy considers risk, assets and liabilities. Risk considered at all levels.

- Take risk to get return. Implement appropriate risk management.

- SAA determines risk and return. Implementation through active and passive.

- Integrate ESG in policies. ESG considerations material to long-term sustainability of the Fund.

- Play a developmental role in SA and Africa. Consider wider stakeholder views.

- Support reputation with robust and rational investment decisions from skilled and competent investment professionals.

- Minimize costs. Promote alignment of interests with fees.

- Accountability and high ethical standards required from trustees, administrators and investment managers.

- Commitment to high standards of openness, transparency and appropriate disclosure.

Investment Performance

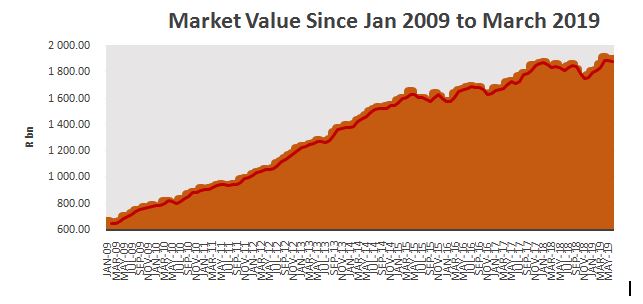

The following charts shows the market value growth over time since January 2009 to March 2019.

Detailed investment performance and the list of all the Fund’s investments can be found in the Fund’s annual report.